Making the decision to outsource your accounting and bookkeeping needs is a big one. It can be a tough decision to make, but we’re here to help. Here are a few things to consider when making your decision:

What are your specific needs?

Do you need someone to help with your bookkeeping on a regular basis? Do you need someone to prepare your taxes? Do you need someone to help you with your business finances? Knowing exactly what you need will help you narrow down your options.

What is your budget?

Outsourcing your accounting and bookkeeping needs can be a big expense. You’ll need to factor in the cost of the services you need, as well as the cost of any software or tools that you’ll need to use. Don’t forget to factor in the cost of training, too.

What are your time constraints?

Do you have the time to train someone on your Nitschke Nancarrow Accountants accounting and bookkeeping needs? Do you have the time to do the work yourself? If you’re short on time, you may want to consider outsourcing your needs.

What is your level of expertise?

Are you an expert in accounting and bookkeeping? If not, you may want to consider outsourcing your needs to someone who is. Outsourcing your needs to a professional can save you a lot of time and headaches.

What are your long-term goals?

Do you plan on growing your business? If so, you’ll need to factor that into your decision. Outsourcing your accounting and bookkeeping needs can help you free up time to focus on growing your business.

Making the decision to outsource your accounting and bookkeeping needs is a big one. But, with a little thought and consideration, you can make the decision that’s best for you and your business.

Get Expert Help

When it comes to your finances, it’s important to get expert help to ensure that you’re on the right track.

At Nitschke Nancarrow, we have a team of experienced accountants who can provide you with the advice and support you need to make the most of your money.

There are a number of ways that our accountants can help you, including:

1. Reviewing your financial situation and providing advice on how to improve it

2. Helping you to budget and plan your finances so that you can save money

3. Assisting you with tax planning and preparing your tax return

4. Providing advice on investment opportunities and how to grow your wealth

5. Helping you to navigate through financial challenges such as divorce or job loss

If you’re looking for expert help with your finances, contact Nitschke Nancarrow today. We’ll be happy to discuss your needs and provide you with the support you need to get your finances on track.

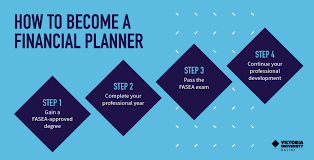

Introduction To Financial Planning

Financial planning is the process of forecasting future financial outcomes and making decisions today that will help achieve desired results.

It involves setting goals, evaluating current finances, estimating future needs and risks, and implementing a plan to reach the desired state.

Individuals, families and businesses all need to financial plan to some extent. The process can be as simple as creating a budget to track spending and saving, or as complex as developing a comprehensive retirement plan. No matter the level of complexity, financial planning can help achieve financial security and peace of mind.

Nitschke Nancarrow Accountants can help you with all aspects of financial planning. We can assist with budgeting, cash flow management, goal setting, retirement planning, investment planning and more. We tailor our services to meet your unique needs and circumstances.

Contact us today to learn more about how we can help you achieve your financial goals.

The Benefits Of Financial Planning

When it comes to financial planning, there are a lot of different benefits that can be gained. It can be difficult to know where to start, or even what financial planning is, but the truth is that anyone can benefit from financial planning.

The first benefit of financial planning is that it can help you to save money. When you have a plan in place, you are more likely to be able to stick to it and save money over time.

This can be a great way to make sure that you have money set aside for retirement or for a rainy day.

Another benefit of financial planning is that it can help you to invest money. If you have a plan in place, you can make sure that you are investing your money in the right places.

This can help you to grow your money over time adelaideaccountancy.com.au and make sure that you are getting the most out of your investments.

Finally, financial planning can help you to protect your assets. If you have a plan in place, you can make sure that your assets are protected in the event of a financial emergency.

This can help you to keep your family safe and secure and to make sure that you are able to weather any financial storms that come your way.

These are just a few of the benefits of financial planning. If you are not sure where to start, there are a number of resources available to help you.

You can speak to a financial planner, or even look online for resources. The most important thing is to get started, and to make sure that you have a plan in place.